The global automotive industry demonstrated remarkable resilience in 2023, navigating geopolitical complexities and economic headwinds to achieve a robust 10% sales increase. A total of 78.32 million new passenger cars were sold across 151 markets worldwide, marking a significant recovery from the previous year. This surge underscores the enduring demand for personal vehicles and highlights shifting dynamics within the global auto market, particularly the rise of new market leaders and the growing popularity of certain vehicle types, most notably, the Best Selling Auto models in key segments.

Global Sales Growth and Regional Performance

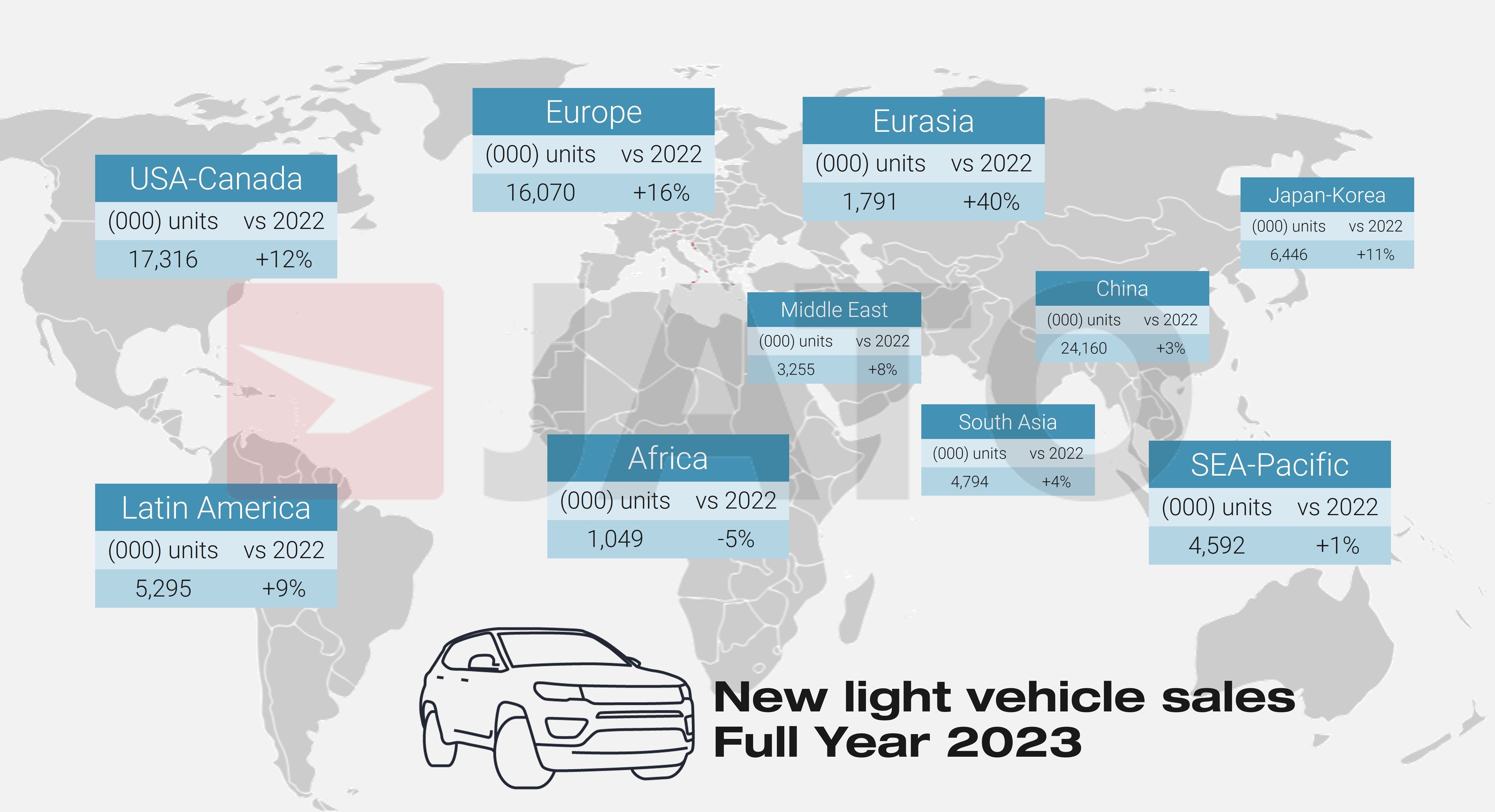

Despite persistent global uncertainties, including tensions between major economies, European conflicts, and high interest rates in the West, the automotive sector experienced notable growth. While China, a major automotive market, saw a 6% increase in sales volume compared to 2022, North America (USA-Canada) and Japan-Korea regions outperformed with a 12% growth rate. Europe emerged as the fastest-growing market, fueled by strong demand in Turkey and government incentives promoting electric vehicle (EV) adoption. Conversely, Africa was the only region to experience a sales decline, dropping by 6% due to economic challenges in key markets like Egypt. However, most global regions contributed to the overall positive trend, indicating a broad recovery in automotive demand.

Emerging Markets Powering Auto Sales

A significant portion of global automotive sales growth in 2023 originated from emerging economies. These markets accounted for 22% of all new car sales, translating to over 17.5 million vehicles – exceeding the total sales volume of either the US or Europe. India led this surge, becoming the fourth-largest individual market globally with 4.19 million passenger cars sold. Brazil and Iran followed with substantial sales figures, alongside Mexico and Turkey, demonstrating the increasing importance of these regions in the global automotive landscape. This growth in emerging markets is partly attributed to the rising affordability and appeal of Chinese car brands, which are gaining traction due to competitive pricing and feature-rich offerings compared to legacy automakers.

Brand Power Shift: Chinese Brands Overtake American

A noteworthy shift in the automotive industry in 2023 was the ascent of Chinese brands, which for the first time, outsold American brands globally. Chinese-origin brands achieved a remarkable 23% sales increase, reaching 13.43 million new cars sold, while American brands grew by 9% to 11.93 million units. Japanese brands maintained their leading position with 23.59 million units sold, but the rapid growth of Chinese manufacturers signals a significant change in the global brand hierarchy. This success of Chinese brands is particularly pronounced in emerging markets, the Middle East, Eurasia, and Africa, and increasingly in developed economies like Europe and Australia. This expansion is driven by a combination of factors, including competitive pricing, advanced technology in EVs, and strategic market penetration.

SUV Dominance Continues: Best Selling Auto Body Type

The global trend towards SUVs continued its strong momentum in 2023, solidifying SUVs as the best selling auto body type worldwide. With 36.72 million units sold, SUVs achieved a record market share, representing nearly 47% of all global passenger car sales. This 16% increase in SUV sales volume from the previous year is attributed to the versatility, appealing designs, and evolving features of SUV models. Tesla’s significant growth in the SUV segment (+62%) played a key role, alongside increased SUV demand across Europe, India, the Middle East, and Eurasia. China and the USA-Canada remain the largest markets for SUVs, collectively accounting for over half of the global SUV sales. The continuous innovation and adaptation of SUV models by manufacturers have ensured their enduring popularity and market dominance.

Tesla Model Y: The Best Selling Auto Globally

In a historic milestone for the automotive industry, the Tesla Model Y emerged as the world’s best selling auto in 2023. This midsize SUV achieved the top global ranking, becoming the first ever pure electric vehicle to lead the worldwide market. Tesla Model Y’s success is particularly noteworthy as it achieved this top position without significant presence in most emerging markets, where its price point remains a barrier for many consumers. Despite this limitation, the Model Y’s global sales totaled 1.22 million units, a remarkable 64% increase from 2022. This volume surpassed traditional top-selling models like the Toyota RAV4 and Corolla sedan, demonstrating the growing consumer acceptance of EVs and Tesla’s market leadership in this segment.

While the Toyota RAV4 and Honda CR-V remained strong contenders, and the Toyota Corolla sedan faced declining sales, the Tesla Model Y’s ascent to the top reflects a significant shift in consumer preferences and the automotive landscape. The rise of EVs and the popularity of SUV body styles are converging, with the Model Y perfectly embodying both trends to become the best selling auto of 2023 and a symbol of the evolving automotive future.

In Conclusion

The global automotive market in 2023 showcased resilience and growth, driven by emerging economies and the sustained popularity of SUVs. Chinese brands emerged as significant players, challenging established market leaders, and electric vehicles gained further mainstream acceptance, culminating in the Tesla Model Y becoming the world’s best selling auto. These trends indicate a dynamic and evolving automotive landscape, with continued growth expected in key regions and segments, and a growing emphasis on electric and SUV models in the years to come.