For car enthusiasts in India, the desire to enhance or maintain their vehicles often leads to exploring international markets for specialized or high-quality Car Parts India might not readily offer. Importing car parts India from overseas, such as performance upgrades or rare components, can significantly elevate your car ownership experience. However, navigating the process can seem daunting, especially when considering customs duties, shipping logistics, and regulatory compliance.

This guide aims to demystify the importation of car parts India, drawing upon expert insights to ensure a smooth and hassle-free experience. Whether you’re looking to import AMG wheels like our enthusiast benz220, or any other automotive component, understanding the intricacies of international shipping and Indian customs is crucial.

Essential Documentation and Details for Importing Car Parts to India

One of the foundational aspects of successfully importing car parts India is meticulous documentation. Ensuring your paperwork is accurate and aligned with customs requirements can prevent significant delays and complications.

A critical point to remember is the consistency of your name across all documents. As BHPian Rehaan emphasizes, “Ensure the buyer’s name mentioned in the mailing address & invoice matches your ID proof (eg. Aadhaar) !!EXACTLY!!.” This alignment is paramount. Ideally, your shipping address should match your Aadhaar address for simplicity. If you require delivery to a different address, supplementary documents like lease agreements or utility bills in your name might be necessary. In some cases, a No Objection Certificate (NOC) from the person whose name is on the address proof might suffice, but sticking to your Aadhaar address is generally the easiest route.

Furthermore, the invoice itself is a key document. It must be a proper “Invoice” or “Tax Invoice,” not a “Proforma Invoice.” Crucially, the Harmonized System Nomenclature (HSN) code for the car parts India you are importing must be clearly and accurately stated on the invoice. This HSN code is the primary determinant of the customs duty you will be levied. Online tools, such as the one shown in the image above from cybex.in, can help you cross-check the expected customs duty based on the HSN code 8708 for vehicle parts and accessories.

Understanding the Landscape of Customs Duty and Charges for Car Parts India

While online tools provide estimates, the final customs duty for car parts India imports can often be more complex than initially anticipated. It’s essential to understand the various components that make up the total import charges.

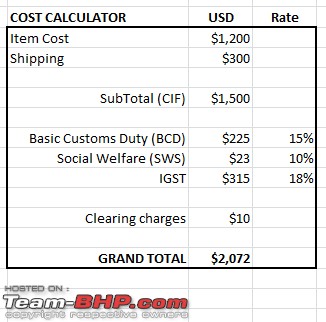

Customs duty is calculated not just on the cost of the goods but also on the shipping cost. Adding to this is the Social Welfare Surcharge (SWS), typically around 10% of the Basic Customs Duty, translating to approximately 1% overall. Countervailing Duty (CVD) might also be applicable, depending on the specific car parts India being imported. Finally, Integrated Goods and Services Tax (IGST), which can range from 12% to 18% (and sometimes even 28% for items categorized as “jewelry” or luxury goods), is applied to the cumulative cost, including goods, shipping, customs duty, SWS, and CVD.

Screenshot of a rough customs duty calculation example

Screenshot of a rough customs duty calculation example

The image above illustrates a rough calculation, but it’s prudent to prepare for potential additional charges to avoid surprises. Having a personal Goods and Services Tax Identification Number (GSTIN) might have implications for business imports, and while not always necessary for personal imports, providing your Permanent Account Number (PAN) to the shipper is mandatory for customs documentation.

Navigating Shipping and Logistics for Car Parts India

The shipping method and the company you choose play a significant role in the ease and efficiency of importing car parts India. Reputable international couriers like FedEx and DHL are often recommended for their comprehensive services. As BHPian pranavt notes, “DHL…still are at the top of their game and by-far the best shipping company for small-medium air shipping.”

These companies often offer Delivered At Place (DAP) service, meaning they handle the entire shipping process, including customs clearance, and deliver the car parts India directly to your doorstep. They will typically contact you for KYC (Know Your Customer) details and provide a payment link for customs charges, which you can pay online before delivery. While convenient, these services may include handling or processing charges. It’s also advisable to discuss shipping options and costs with the seller, as there might be options for economy or priority shipping that can impact the overall expense. For bulky items like wheels, be prepared for potentially higher shipping costs due to size and weight.

Understanding INCOTERMS (International Commercial Terms) is also beneficial. While Delivery Duty Paid (DDP) might sound appealing as it implies the seller handles all duties, it can sometimes lead to complications. DAP is generally considered a safer and more transparent option.

Key Considerations for a Smooth Import of Car Parts India

To ensure a seamless import experience for car parts India, keep these crucial points in mind:

- Address Accuracy: Reiterate the importance of your shipping address precisely matching the address on your ID proof. Discrepancies can lead to delays and the need for additional address verification documents like utility bills.

- KYC Compliance: Shipping companies will promptly request KYC details once your shipment is dispatched. Respond swiftly to avoid delays in customs clearance.

- Expect Higher Costs: Mentally prepare to pay more than just the item cost and initial shipping. Customs duties and other charges can significantly increase the final amount.

- Request Bill of Entry (BOE): For a detailed breakdown of all charges, request the Bill of Entry from the shipper or clearing agent. This document provides a comprehensive overview of HSN codes, duty break-up, and other levied charges.

Importing car parts India can be a rewarding way to access specialized automotive components. By understanding the customs procedures, documentation requirements, and shipping logistics, and by choosing reputable shipping partners, you can navigate the process effectively and enhance your vehicle with parts sourced from around the globe. Remember, preparation and attention to detail are key to a successful import experience.