In many professions, driving is an integral part of the job. If your company doesn’t provide a fleet of vehicles or a dedicated company car, you might receive a car allowance as part of your salary. This financial provision is designed to help cover the costs associated with using your personal vehicle for work-related purposes.

A car allowance can assist with both the purchase and upkeep of a vehicle used for work. However, it’s important to understand that, except in specific locations, employers aren’t legally obligated to offer a car allowance. Furthermore, the amount and terms of a car allowance are at the employer’s discretion.

Understanding How Car Allowance Works for Employees

Typically, a Car Allowance As Part Of Salary is a fixed sum added to your regular paycheck each pay period. This payment is intended to offset the various expenses you incur while using your own car for business activities. The amount is usually predetermined by your employer.

A well-structured vehicle allowance should account for both the fixed and variable costs associated with using your car for work. These costs encompass fuel, insurance, general wear and tear, routine maintenance, and other vehicle-related fees.

Fixed vs. Variable Expenses: Key Considerations for Your Car Allowance

When your employer calculates your car allowance as part of salary, they should carefully consider the distinction between fixed and variable vehicle expenses. Understanding these categories is crucial for ensuring your allowance adequately covers your costs.

Variable expenses, such as fuel and maintenance, fluctuate significantly. These costs not only change from month to month for each employee but are also heavily influenced by geographical location, impacting fuel prices, maintenance costs, and even driving conditions.

Therefore, if you are receiving a fixed car allowance as part of your salary, it’s vital to assess whether the amount is realistically aligned with your current vehicle expenses. Consider factors like local fuel prices, insurance rates, and typical maintenance costs in your area to determine if the allowance provides sufficient coverage.

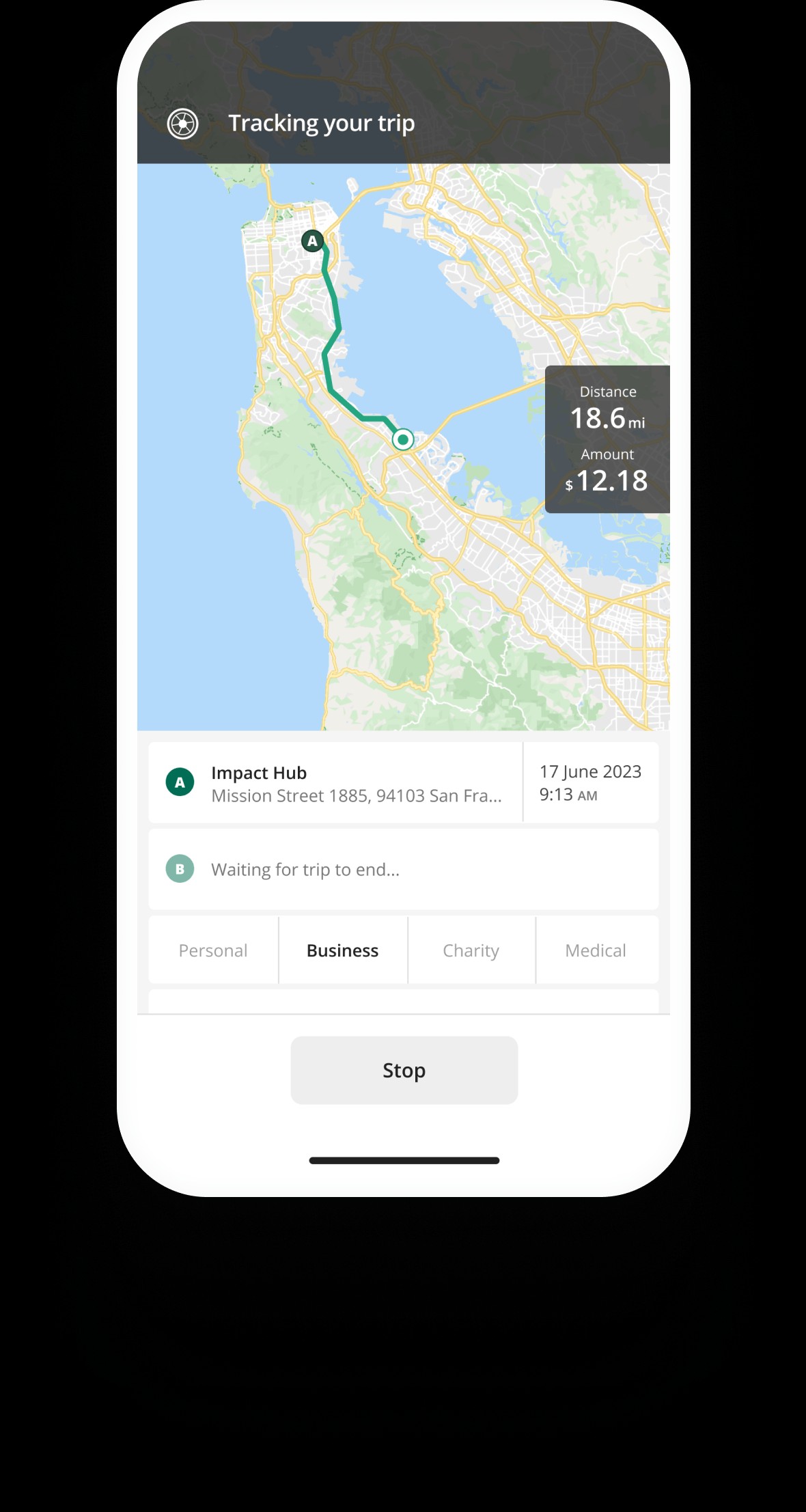

Mileage Tracking App Interface

Mileage Tracking App Interface

Utilizing Your Car Allowance for Vehicle Acquisition

Many companies opt to include a car allowance as part of salary directly within your regular paycheck. Once these funds are paid to you, they become your personal funds and can be used as you see fit, including for purchasing or leasing a vehicle.

It’s crucial to remember that when you use your car allowance to buy a car, you are the purchaser. The car contract and ownership will be in your name. In certain situations, proof of your car allowance as part of salary may be accepted by car dealerships as evidence of your ability to meet car loan payments. However, this is not universally guaranteed and can vary between dealerships and financial institutions.

Covering Vehicle Maintenance with Your Car Allowance

A car allowance as part of salary is specifically designed to cover all expenses related to using your personal vehicle for business purposes, and this definitely includes vehicle maintenance. This means your car allowance should account for routine wear and tear, as well as regular maintenance tasks like oil changes, tire rotations, and other upkeep necessary to keep your car in good working order.

To better understand the scope of your car allowance, it’s helpful to categorize vehicle costs into operational and ownership expenses.

Operational Costs (examples):

- Fuel

- Engine oil and fluids

- Routine maintenance services

- Tire replacement and repairs

Ownership Costs (examples):

- Vehicle Depreciation

- Car Insurance premiums

- Vehicle license and registration fees

Understanding these cost categories will help you assess if your car allowance as part of salary is realistically covering the full spectrum of expenses you incur for business-related driving.

Car Allowance and Mileage Reimbursement: Can You Receive Both?

It’s a common question among employees receiving a car allowance as part of salary: can you also receive mileage reimbursement? The answer is yes, in many cases, and sometimes it’s even legally required. Even if you receive a car allowance, you might still be eligible for mileage reimbursement at the standard IRS rate for your business miles driven. In some states, like California, it is mandated by law that employers reimburse employees for business-related expenses, including mileage, regardless of whether they also receive a car allowance.

IRS-Approved Reimbursement: The FAVR Program

For a more structured and potentially tax-advantageous approach to vehicle reimbursement, employers can utilize an IRS-approved program known as the Fixed and Variable Rate (FAVR) program. A FAVR plan combines fixed and variable payments to reimburse employees for vehicle expenses.

FAVR plans offer several benefits. The fixed payment component can be customized to reflect the specific fixed costs in an employee’s location, such as insurance and registration fees. The variable payment component, typically based on mileage, addresses fluctuating costs like fuel and maintenance directly related to business driving. This combination allows employers to more accurately compensate employees, preventing both under-reimbursement and over-reimbursement of vehicle expenses.

Tax Implications of Car Allowances

It’s essential to be aware that car allowances as part of salary are generally considered taxable income, just like your regular wages. This means that the car allowance amount is subject to income tax and payroll taxes. This taxability underscores the importance of carefully tracking your vehicle expenses and understanding the net benefit you receive from the car allowance after taxes are deducted.

However, there is a distinction regarding mileage reimbursement. If your employer reimburses you separately for your business mileage driven in your personal vehicle, these mileage reimbursements are typically non-taxable, provided that the reimbursement rate does not exceed the federal mileage rate set by the IRS. Staying within the IRS mileage rate allows for tax-free reimbursement of your business driving expenses.

To simplify mileage tracking and ensure IRS compliance, employees can utilize mileage tracker apps. Accurate mileage logs are crucial for potential mileage reimbursement claims, especially in states where employers are required to reimburse for all business travel expenses, even if a car allowance is provided. In these instances, meticulous mileage records are necessary to present to your employer for proper reimbursement.

FAQ: Car Allowance as Part of Salary

Is a vehicle allowance taxed?

Yes, generally, the IRS considers a vehicle allowance to be taxable income. This is because a car allowance is typically a fixed payment not directly tied to specific mileage or substantiated expenses. As such, it’s treated as additional compensation and is therefore subject to taxation.

What is the average vehicle allowance?

The average vehicle allowance can vary significantly depending on industry, job level, and location. However, a commonly cited average vehicle allowance is approximately $600 per month. It’s important to note that allowances can be higher, particularly for executive-level positions or roles requiring extensive travel.

What does a car allowance cover?

A car allowance as part of salary is intended to cover the overall costs of owning and operating a vehicle, proportionate to the vehicle’s business use. This broad coverage includes operational costs like fuel, oil, and routine maintenance, as well as ownership costs such as car insurance, vehicle depreciation, and registration fees, among others. The key is that the allowance is meant to offset the expenses incurred due to using your personal car for work.

What tax do you pay on a car allowance?

Car allowances are taxed as part of your regular income. The specific tax rate you pay will depend on your overall income level and your corresponding income tax bracket. Car allowances are subject to the same federal, state, and local income taxes, as well as payroll taxes like Social Security and Medicare, that apply to your base salary.