Car maintenance is an unavoidable cost for vehicle owners, and when you use your car for business, the question of tax deductibility arises. If you’re self-employed, understanding what car expenses, including parts, you can write off on your taxes is crucial for maximizing your deductions. This guide will clarify whether you can deduct car parts on your taxes and how to properly claim these deductions.

Who is Eligible to Deduct Car Parts and Repairs?

The ability to deduct car part expenses isn’t available to everyone. It’s primarily intended for individuals who use their vehicles for business purposes. The IRS allows specific categories of taxpayers to write off car part and repair expenses:

- Self-Employed Individuals: This is the most common category, including freelancers, independent contractors, and small business owners who operate as sole proprietors.

- Gig Economy and Delivery Drivers: Drivers for platforms like Uber, Lyft, DoorDash, and delivery services who use their personal vehicles for work.

- Armed Forces Reservists: Reservists who travel more than 100 miles from home in connection with their reserve duties.

- Qualified Performing Artists: Individuals who perform artistic services for two or more employers, with certain expense conditions.

- Fee-Basis State or Local Government Officials: Government officials compensated on a fee basis.

It’s important to note that if you are a W-2 employee, and your employer reimburses your vehicle expenses, you generally cannot deduct car part expenses. Deductions are for those who bear the financial burden of maintaining their vehicles for business use.

Mechanic Inspecting Car Parts for Repair

Mechanic Inspecting Car Parts for Repair

What Car Parts and Repairs are Tax Deductible?

For self-employed individuals, deductible car expenses must be both “ordinary and necessary”. The IRS defines these as:

- Ordinary: Expenses that are common and accepted in your trade or business.

- Necessary: Expenses that are helpful and appropriate for your business.

When it comes to car parts and repairs, this means that the costs must be directly related to maintaining your vehicle for business operations. Expenses for personal vehicle use are not deductible. Common deductible car part and repair costs include:

- Routine Maintenance: Oil changes, tire rotations, and regular servicing that keeps your car running smoothly for business activities.

- Repairs: Fixing mechanical issues, such as engine troubles, brake repairs, transmission problems, or exhaust system fixes that are necessary for business use.

- Replacement Parts: Purchasing new tires, batteries, windshield wipers, headlights, brake pads, mufflers, and other components that wear out or break due to business driving.

- Body Work: Repairs resulting from accidents or damage incurred while using your car for business.

It’s vital to differentiate between business and personal use. If you use your vehicle for both, you can only deduct the portion of car part and repair expenses that corresponds to your business mileage.

Examples of Deductible Car Parts:

- New Tires: Replacing worn tires essential for safe business driving.

- Battery: A new battery to ensure reliable vehicle operation for work.

- Brake Pads: Replacing worn brake pads is crucial for safety during business trips.

- Headlights/Taillights: Ensuring visibility for business-related driving, especially at night.

- Muffler/Exhaust System Components: Repairs to maintain your vehicle’s operational condition for business use.

Examples of Deductible Car Repairs:

- Engine Repair: Fixing engine problems that hinder your ability to perform business activities.

- Transmission Repair: Addressing transmission issues to keep your vehicle functional for work.

- Brake System Repair: Essential repairs to ensure safe braking for business travel.

- Suspension Repair: Maintaining vehicle stability and handling for business driving.

- Body Work after an Accident: Repairing damage from a collision that occurred while on a business trip.

How to Deduct Car Parts and Repair Expenses

There are two primary methods for deducting vehicle expenses, including car parts and repairs, on your tax return: the standard mileage method and the actual expense method.

Standard Mileage Method

This method uses a fixed mileage rate set by the IRS each year. For 2024, the standard mileage rate is 67 cents per mile for business use. While this method is simpler, it does not allow you to separately deduct car repair expenses. The standard mileage rate is designed to encompass all vehicle operating expenses, including depreciation, maintenance, and repairs. If you use the standard mileage method, you cannot also deduct car parts and repairs separately.

Actual Expense Method

The actual expense method allows you to deduct the actual costs of operating your vehicle for business. This includes expenses like gas, oil, insurance, registration fees, depreciation, lease payments, and crucially, car parts and repairs.

To use this method, you must keep detailed records of all your car-related expenses, including receipts for car parts and repair invoices. You then calculate the percentage of your vehicle use that was for business and deduct that percentage of your total actual expenses.

Example: Let’s say you spent $500 on new tires and $300 on brake repairs during the year. If 60% of your total mileage was for business, you could deduct 60% of ($500 + $300) = $480 as car part and repair expenses using the actual expense method.

Where to Claim Car Part and Repair Deductions

For self-employed individuals, car part and repair expenses are typically deducted on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Vehicle expenses are usually reported in Part II, Expenses, of Schedule C.

You may also need to complete Part IV of Schedule C, Information on Your Vehicle. This section requires details about your vehicle usage, such as when you placed the vehicle in service for business, total miles driven, and business miles driven.

Record-Keeping for Car Part and Repair Deductions

Maintaining thorough records is essential when deducting car parts and repair expenses, especially if you use the actual expense method. Good record-keeping practices include:

- Receipts: Keep all receipts for car parts purchased and repair invoices. These should detail the date, vendor, items purchased or services performed, and the amount paid.

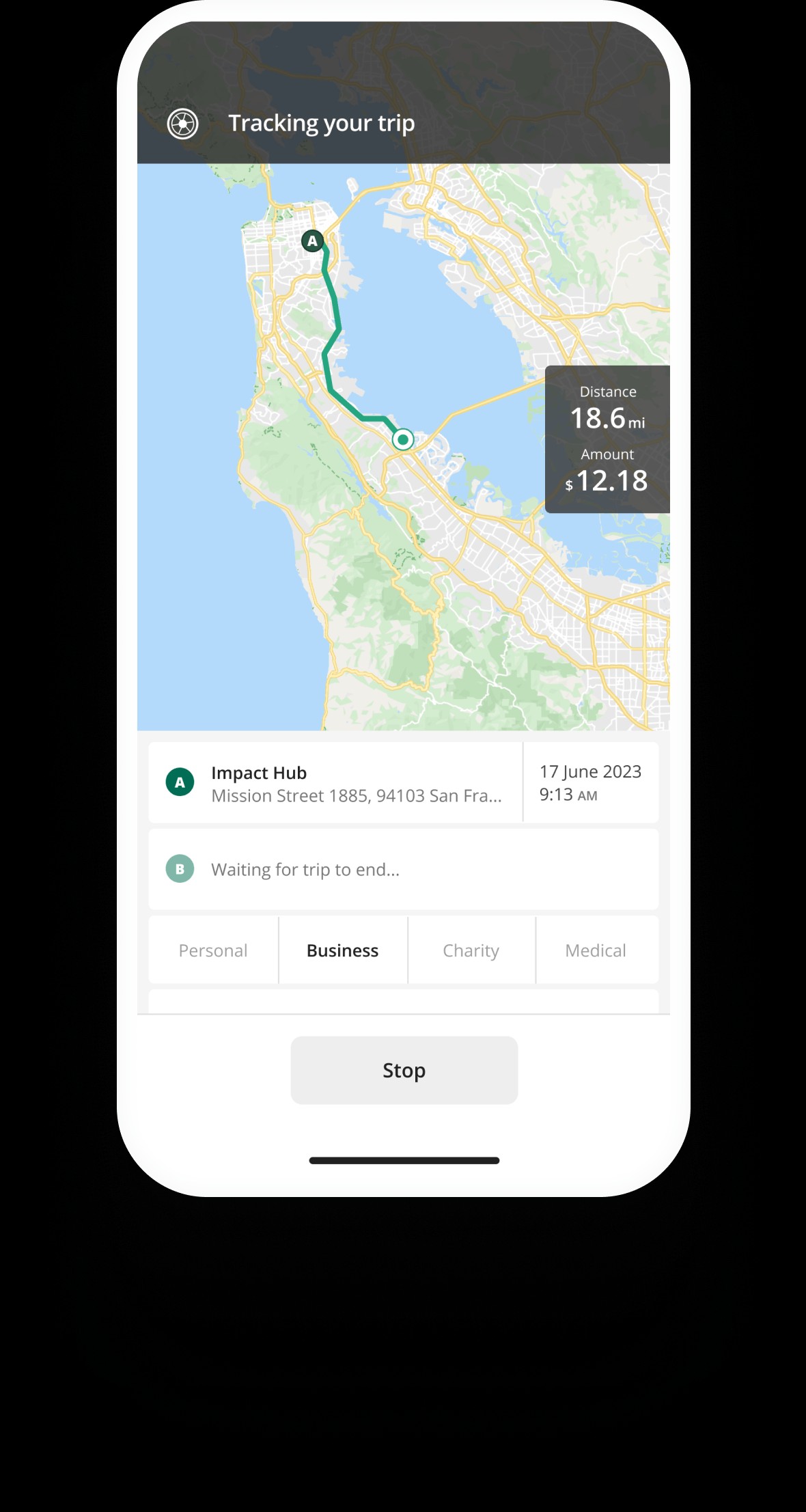

- Mileage Log: Maintain a detailed mileage log to accurately track your business miles. This log should record the date, purpose of the trip, starting and ending locations, and miles driven for each business trip. Mileage tracking apps can simplify this process.

- Annual Expense Summary: Summarize your total car part and repair expenses, along with other vehicle costs, at the end of the tax year to facilitate tax preparation.

By keeping accurate records and understanding the rules for deducting car parts and repairs, self-employed individuals can rightfully reduce their tax liability. Consulting with a tax professional can provide personalized advice based on your specific circumstances.