Dealing with the aftermath of a car accident is stressful enough without the added worry of how your vehicle will be repaired. A common concern for many car owners is whether their insurance company can mandate the use of used parts for repairs, especially when they were not at fault. It’s a valid frustration – you want your car restored to its pre-accident condition using quality components, not potentially unreliable secondhand parts.

The truth is, insurance companies sometimes do opt for used parts to control costs. But are they allowed to, and what does this mean for you? This article, brought to you by the auto repair experts at cardiagxpert.com, will break down your rights and explain how to navigate this often confusing aspect of the car repair process after an accident. Understanding your position and knowing how to work with your repair shop are crucial to ensuring your vehicle is properly restored.

The Legal Principle: Your Duty to Mitigate Damages and Used Auto Parts

After a car accident, a legal concept called the “duty to mitigate damages” comes into play. Essentially, this means you have a responsibility to avoid unnecessary expenses in the repair process. Insurance companies will often use this principle to justify the use of used parts, arguing that it’s a cost-effective way to return your car to its previous condition. Their reasoning often goes like this: “Your car was already made of used parts, wasn’t it? So, replacing a damaged part with another used part is perfectly acceptable.”

This logic can be particularly frustrating when you’re not at fault for the accident. It feels unfair to have to compromise on repair quality because of someone else’s mistake. However, the legal system often seeks a balance to prevent either party from exploiting the situation. This is where the concept of used parts comes in as a potential compromise.

To effectively navigate this system, building a strong relationship with a trustworthy repair shop is paramount. A shop that advocates for you can be your best ally in ensuring fair and quality repairs, even when used parts are considered.

Navigating the Repair Process: Understanding the Players

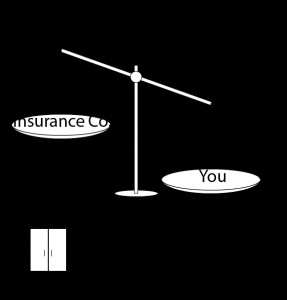

To better understand how used parts might factor into your car repair, it’s helpful to consider the four main players involved in this scenario:

- You (the Car Owner): Your goal is to have your vehicle restored to its pre-accident condition, using quality parts and workmanship.

- The Repair Shop: Ideally, your chosen shop should be an advocate for your interests, aiming to provide the best possible repair while working within the constraints of the insurance claim.

- The Insurance Company (Paying for Repairs): The insurance company’s primary objective is to minimize their costs while still fulfilling their obligation to repair the damage.

- The Parts Vendor: This is the supplier of both new and used auto parts to the repair shop.

When used parts are proposed, the repair shop plays a crucial role in balancing your needs and the insurance company’s cost concerns. While the insurance company may have the right to suggest used parts to mitigate costs, the repair shop has the responsibility to ensure that any used part meets acceptable quality and safety standards.

This means the shop can and should demand that used parts meet specific criteria for condition and functionality. If a used part provided by the insurance company or vendor is deemed substandard, the shop has the right to reject it.

This rejection can initiate a back-and-forth process. The insurance company may then attempt to source another used part, which could also be rejected if it doesn’t meet the required specifications. Eventually, the insurance company may be faced with the decision to either keep searching for acceptable used parts or approve the use of a new part.

The Game of Chicken: Time, Costs, and Frustration

This negotiation process involving used parts can sometimes turn into a frustrating “game of chicken.” The back and forth can lead to delays as parts are sourced, shipped, and potentially rejected. These delays can accrue costs for both the insurance company and potentially you.

While your car sits waiting for parts, it may be incurring storage fees at the repair shop, adding to the overall bill. If your insurance policy includes rental car coverage, the longer the repair takes, the more the insurance company pays for your rental. However, the repair shop may also be under pressure to keep their bays open and avoid prolonged storage of vehicles. And naturally, you want your car back on the road as quickly as possible and avoid the inconvenience.

This situation creates pressure on both sides to find a solution, and sometimes, the parts vendor can offer a helpful compromise.

A Win-Win Solution: Leveraging Vendor Relationships

Repair shops with strong relationships with their parts vendors can sometimes find a mutually beneficial solution. In some cases, vendors are willing to offer discounts on new parts, bringing their cost down to a level comparable to used parts.

In this scenario, the repair shop gets to use a brand new part, ensuring quality and reliability, while the insurance company benefits from a cost that aligns with their budget for used parts. This can be an ideal outcome, resolving the used parts dilemma while maintaining repair quality and minimizing delays.

Who Does the Shop Work For: You or the Insurance Company?

The dynamic between the repair shop, you, and the insurance company is further complicated by the shop’s loyalties. Ideally, your chosen repair shop should prioritize your interests as their customer. These independent shops often build their reputations on quality work and customer satisfaction. They understand that investing time and effort in advocating for quality parts ultimately pays off through customer loyalty and positive word-of-mouth referrals.

In contrast, “preferred” shops often rely heavily on direct referrals from insurance companies. These shops may be incentivized to prioritize the insurance company’s goals of minimizing costs and দ্রুত repair times to maintain their “preferred” status and ensure a steady stream of referrals.

If a preferred shop rejects a used part, causing delays and potentially increasing rental car and storage costs, they might hesitate to do so, fearing repercussions from the insurance company. To offset potential delays from using new parts, they might cut corners in other areas of the repair, potentially compromising quality.

The risk for you is that if the shop feels more accountable to the insurance company than to you, the insurance company’s drive to minimize costs might overshadow your right to appropriate parts and a proper repair process. The ultimate repair might not fully reflect the true extent of the damage to your vehicle.

The Ripple Effect: Repair Costs and Your Injury or Diminished Value Claim

You might wonder, “If the shop gets me a discounted new part, isn’t that a good thing?” In a perfect world, it would be. However, the insurance company’s cost-cutting focus can extend beyond just parts replacement and potentially impact other aspects of your claim, such as personal injury or diminished value.

For example, imagine you sustained whiplash in the accident and sought chiropractic treatment. The insurance company might apply the same “duty to mitigate damages” logic to your medical treatment, questioning the necessity or extent of your care.

They might argue, “Your car repair was only $800. The impact couldn’t have been severe enough for you to be seriously injured. We’re not paying for extensive medical bills.”

In this scenario, a quickly and cheaply repaired vehicle at an insurance-preferred shop, designed to minimize costs for the insurer and expedite referrals, can inadvertently be used against you. Instead of being rewarded for keeping repair costs low, the insurance company might use the low repair cost as justification to deny or minimize your injury claim.

This issue isn’t necessarily due to a single vindictive adjuster. Often, property damage and injury claims are handled by separate adjusters within the insurance company, who may be overworked and rely on quick assessments. Unfortunately, low property damage costs can disproportionately influence an injury adjuster’s initial evaluation, sometimes overshadowing crucial accident details.

Consider this real-life example:

Adjuster: “I see a hospital bill for $20,000. That can’t be related to this minor accident; your client’s car only had $500 in damage, and it happened in a parking lot.”

Attorney: “If you review the police report, you’ll see that your client’s car struck and pinned my client against their own car while they were loading groceries.”

Adjuster: “Oh, I’ll have to review that again.”

Similarly, diminished value claims can be undermined if a repair shop prioritizes cost-cutting over thorough repairs. Diminished value is the loss in your car’s resale or trade-in value due to the accident history. Insurance companies often use formulas based on repair costs and pre-accident vehicle condition to calculate diminished value.

If a shop, under pressure from an insurance relationship, inaccurately reports pre-existing wear and tear to justify used parts, the calculated diminished value can be artificially lowered. The argument becomes, “Your car wasn’t worth much to begin with, and the repairs were cheap, so there’s minimal diminished value.”

While a diminished value appraiser can provide a more accurate assessment, and potentially uncover faulty repairs needing correction, pursuing this can be time-consuming and require legal action to achieve fair compensation.

Protecting Yourself: Choose the Right Repair Shop First

The best way to avoid potential problems with used parts and their broader implications is to proactively choose the right repair shop from the outset. Partnering with a shop known for its commitment to customer service and quality repairs is your strongest defense against substandard used parts and potential claim complications.

When your repair shop is primarily accountable to you, the customer, rather than the insurance company, you can have greater confidence that all damages will be addressed appropriately and at a reasonable cost. This protects not only the quality of your repair but also safeguards any injury or diminished value claims you might pursue. It also rewards repair shops that prioritize quality and customer satisfaction over simply cutting corners to appease insurance companies.

While you may have to accept some used parts due to your duty to mitigate damages, working with a trusted shop ensures that any used parts used on your vehicle meet acceptable standards and function effectively. Furthermore, a strong shop, with good vendor relationships, may even be able to negotiate new parts at a price acceptable to the insurance company, eliminating the used parts issue altogether.

We Can Help You Find a Quality Repair Shop

At cardiagxpert.com, we understand the complexities of car repairs after accidents and the importance of choosing the right partners. We work with a network of reputable repair shops across the valley that have consistently demonstrated their commitment to excellent workmanship and customer satisfaction.

One of our top priorities for our clients is to ensure their vehicles are repaired quickly, effectively, and to the highest standards. A quality repair shop is crucial in getting you back on the road safely and with your car in the best possible condition. We also rely on these trusted shops to document repairs thoroughly and coordinate with diminished value appraisers when necessary. Their meticulous work provides a solid foundation for any subsequent injury or diminished value claims.

If you’re navigating property damage after a car accident and concerned about used parts, we strongly recommend choosing a repair shop with a proven track record of customer service. If you need assistance with your vehicle repair and want to explore a potential personal injury or diminished value claim, or simply want to understand your options, contact us for a free consultation with an experienced accident attorney. We’re here to help you analyze your situation and guide you forward, without any obligation.