BMW Motorrad Insurance: What You Need to Know Before You Ride

Owning a BMW motorcycle is a dream come true for many. The thrill of the open road, the feel of the wind in your hair, and the prestige of riding a high-performance machine are experiences unmatched by anything else. However, before you hit the asphalt, it’s crucial to have the right Bmw Motorrad Insurance to protect your investment and yourself from unforeseen circumstances. This article delves into everything you need to know about BMW motorcycle insurance, empowering you to make informed decisions and ride with confidence.

BMW Motorrad Insurance Policy

BMW Motorrad Insurance Policy

Factors Affecting BMW Motorcycle Insurance Costs

Understanding the factors influencing your insurance premiums is key to finding the best coverage at a competitive price. Here are some crucial aspects that insurance providers consider:

- Model and Value of Your BMW Motorcycle: The type and value of your BMW motorcycle significantly impact your insurance cost. High-performance models like the BMW S 1000 RR typically command higher premiums due to their increased value and potential repair costs.

- Your Riding History and Experience: Your riding history, including any past claims or traffic violations, plays a vital role in determining your insurance rates. Riders with clean records often qualify for lower premiums.

- Your Location: Where you live and store your motorcycle influences your insurance premiums. Urban areas with higher rates of theft and accidents may result in higher insurance costs.

- Your Coverage Choices: The level of coverage you choose directly affects your premium. Opting for comprehensive and collision coverage, while providing greater protection, will result in higher costs compared to basic liability coverage.

- Deductible Options: Selecting a higher deductible can lower your premium, but it also means you’ll pay more out-of-pocket in case of an accident.

Types of BMW Motorcycle Insurance Coverage

When it comes to insuring your prized possession, several types of coverage are available to provide comprehensive protection.

Liability Coverage

This type of coverage is mandatory in most states and covers bodily injury and property damage you may cause to others in an accident where you are at fault.

Collision Coverage

Collision coverage comes into play if your motorcycle is damaged in a collision with another vehicle or object, regardless of who is at fault. This coverage helps pay for repairs or replacement of your bike, up to its actual cash value.

Comprehensive Coverage

Comprehensive coverage safeguards your motorcycle from non-collision events, including theft, vandalism, fire, natural disasters, and falling objects.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a motorist who either has no insurance or insufficient insurance to cover your damages or medical expenses.

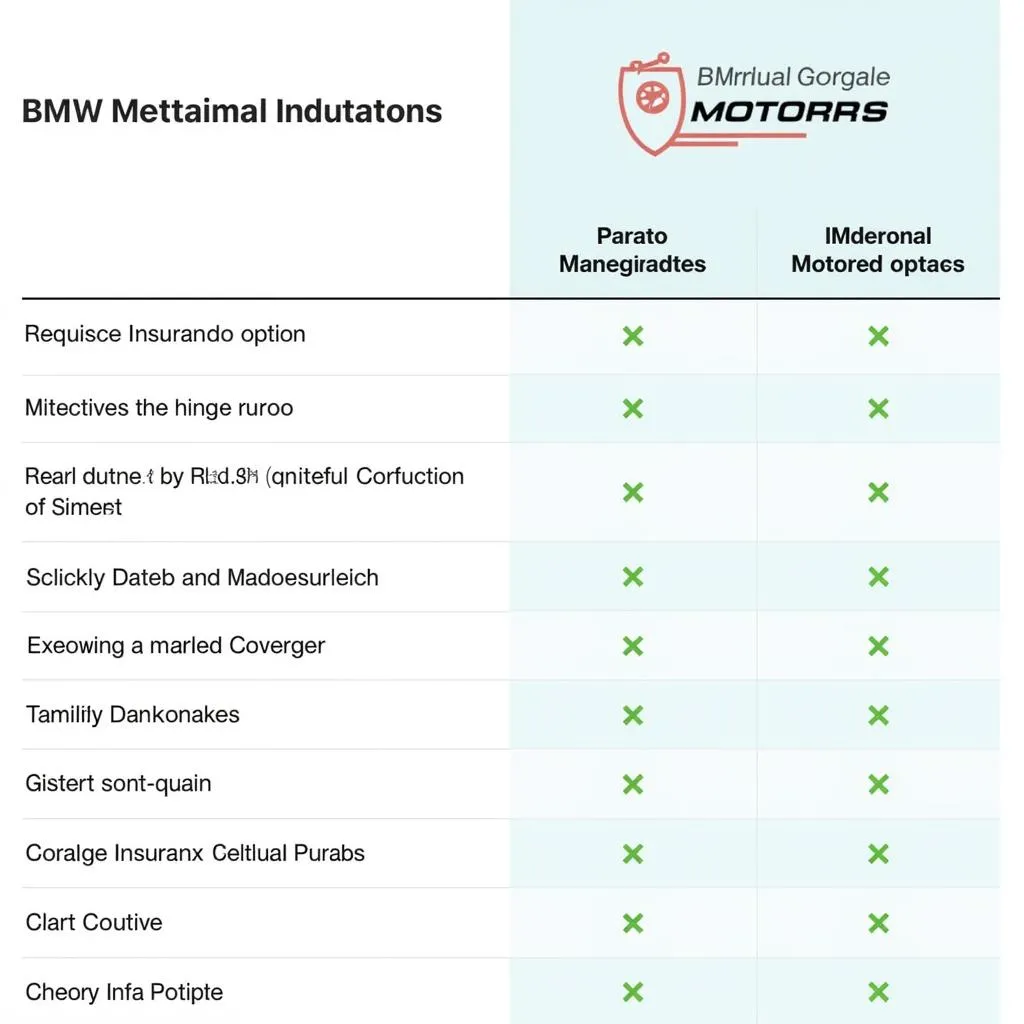

BMW Motorrad Insurance Options

BMW Motorrad Insurance Options

Finding the Right BMW Motorrad Insurance

Choosing the right insurance policy requires careful consideration of your individual needs and budget. Here are some valuable tips:

- Shop Around and Compare Quotes: Don’t settle for the first quote you receive. Get quotes from multiple insurance providers to compare coverage options and pricing.

- Inquire About Discounts: Many insurers offer discounts for various factors, such as having a clean driving record, completing a motorcycle safety course, installing security devices, or bundling your motorcycle insurance with other policies.

- Read the Policy Carefully: Before signing any documents, thoroughly review the policy terms and conditions to understand your coverage, deductibles, exclusions, and limitations.

- Maintain Open Communication with Your Insurer: Inform your insurance company about any changes to your motorcycle, riding habits, or address to ensure your coverage remains accurate and up-to-date.

Frequently Asked Questions (FAQs)

Do I need insurance if I only ride my BMW motorcycle occasionally?

Yes, even if you only ride occasionally, you are still required to have at least the minimum liability insurance coverage mandated by your state.

Can I add accessories to my BMW motorcycle insurance policy?

Yes, you can typically add coverage for aftermarket parts and accessories, such as custom exhaust systems, saddlebags, or GPS units, to your policy.

What should I do if I’m involved in an accident?

If you’re involved in an accident, ensure your safety and the safety of others involved. Contact the authorities, gather necessary information at the scene, and report the accident to your insurance company as soon as possible.

Can I transfer my BMW Motorrad insurance to another motorcycle?

You may be able to transfer your insurance policy to a different motorcycle, but the coverage and premiums may be adjusted based on the new bike’s specifications and value.

Conclusion

Securing the right BMW Motorrad insurance is an essential step in responsible motorcycle ownership. By understanding the different coverage options, factors affecting premiums, and tips for finding the best deal, you can ride your BMW motorcycle with peace of mind, knowing you have the protection you need. Remember, investing in comprehensive coverage ensures that you can enjoy countless miles of exhilarating rides while safeguarding yourself and your valuable asset.

Don’t forget to check out our other resources for BMW motorcycle enthusiasts, including information on BMW M 1000 RR for sale and BMW motorcycles Vancouver BC.

BMW Motorrad Motorcycle on Open Road

BMW Motorrad Motorcycle on Open Road

If you need assistance with any car diagnostic needs, feel free to contact us via WhatsApp: +1(641)206-8880, Email: [email protected], or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a dedicated customer support team available 24/7 to assist you.