The landscape of healthcare in the United States is complex, and for seniors and individuals with disabilities relying on Medicare, understanding the nuances of prescription drug coverage is crucial. A key component of this is Medicare Part D, the program designed to help beneficiaries with the cost of prescription medications. The Affordable Care Act (ACA), also known as Obamacare, brought significant changes to Medicare Part D, particularly concerning the “coverage gap,” often referred to as the “donut hole.” This article delves into how the Affordable Care Act impacted the Medicare Part D coverage gap, focusing on the manufacturer discounts and their effects on beneficiaries’ out-of-pocket spending.

Prior to the ACA, Medicare Part D enrollees faced a significant financial hurdle when they entered the coverage gap. This gap occurred after a beneficiary and their Part D plan had spent a certain amount on covered drugs. Once in the gap, beneficiaries were responsible for a much larger share of their prescription drug costs. The Affordable Care Act aimed to alleviate this burden by introducing manufacturer discounts on brand-name drugs within the coverage gap.

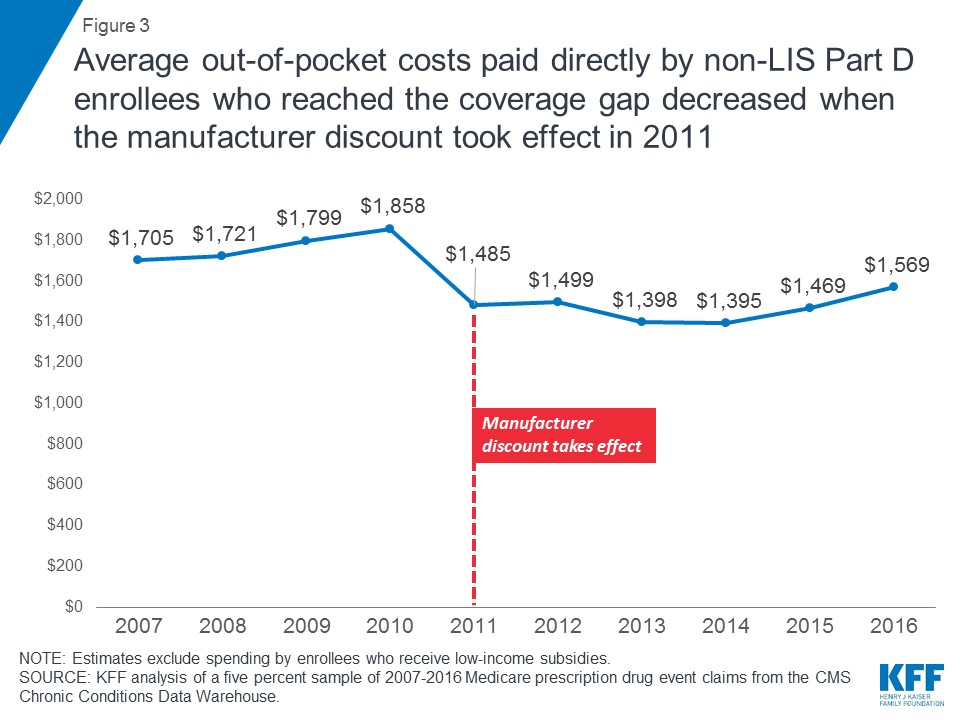

Figure 3 illustrates the impact of these discounts. In 2016, for instance, non-LIS (Low-Income Subsidy) Part D enrollees who reached the coverage gap spent an average of $1,569 out-of-pocket. This represents a notable decrease from the pre-ACA era. Specifically, between 2010 and 2011, when the 50 percent manufacturer discount took effect, and plans started covering a portion of generic drug costs within the gap, average out-of-pocket expenses for these enrollees dropped from $1,858 to $1,485. While there were fluctuations in subsequent years, the overall trend indicates a reduction in out-of-pocket costs directly attributable to the ACA’s provisions.

The Growing Value of Manufacturer Discounts for Part D Enrollees

The manufacturer discount embedded within the ACA has provided substantial financial relief to Medicare Part D enrollees who face high prescription drug costs. For those non-LIS Part D enrollees who entered the coverage gap in 2016, the average manufacturer discount on brand-name medications reached $1,090. This is a significant increase from the $565 average discount received in 2011, as shown in Figure 4. This growth in discount value reflects both rising drug prices and increased utilization, underscoring the growing importance of this ACA provision in moderating drug costs for beneficiaries.

As total spending on Part D drugs has increased, and more non-LIS beneficiaries have entered the coverage gap, the total aggregate discount received by Part D enrollees on brand-name drugs has also risen dramatically. This aggregate discount surged from $2.2 billion in 2011 to $5.7 billion in 2016, highlighting the extensive financial impact of the ACA’s coverage gap modifications.

An important consequence of including the manufacturer discount in the calculation of beneficiary out-of-pocket costs is the increased number of non-LIS Part D enrollees qualifying for catastrophic coverage. Catastrophic coverage kicks in after a beneficiary’s out-of-pocket spending reaches a certain threshold, offering significant cost protection for very high drug expenses. Because the manufacturer discount effectively lowers the amount beneficiaries have to spend out-of-pocket to get through the coverage gap, they reach this catastrophic phase sooner. Figure 5 demonstrates this trend.

Between 2011 and 2016, the number of non-LIS Part D enrollees qualifying for catastrophic coverage doubled, growing from 0.5 million to 1.0 million. Interestingly, their average out-of-pocket costs during this period increased only modestly by 6 percent, from $3,004 to $3,196. This shift towards more beneficiaries reaching catastrophic coverage has contributed to the growth in Medicare Part D spending in recent years. Medicare shoulders 80 percent of enrollees’ total drug costs once they enter the catastrophic coverage phase. MedPAC (Medicare Payment Advisory Commission) reports that Medicare spending on reinsurance, which covers catastrophic expenses, has become the largest and fastest-growing component of Part D program expenditures.

Future Changes to the Coverage Gap and Out-of-Pocket Thresholds

Looking ahead, the Medicare Part D coverage gap has undergone further changes. Notably, as of 2019, the coverage gap for brand-name drugs was effectively closed due to modifications introduced by the Bipartisan Budget Act (BBA). In 2019, beneficiary coinsurance for brand-name drugs within the gap became 25 percent, mirroring the cost-sharing arrangement before reaching the coverage gap. The coverage gap for generic drugs was scheduled to close in 2020, as originally outlined in the ACA. In 2019, beneficiaries paid 37 percent of generic drug costs in the gap, with plans covering the remaining 63 percent.

Furthermore, the annual out-of-pocket spending threshold, which determines when enrollees exit the coverage gap and qualify for catastrophic coverage, was slated to increase significantly between 2019 and 2020. This threshold was set to rise by $1,250, from $5,100 to $6,350. This substantial single-year increase resulted from the expiration of an ACA provision that had modified the calculation of this threshold between 2014 and 2019. From 2020 onwards, the threshold calculation reverted to the pre-ACA methodology.

For Part D enrollees primarily using brand-name medications and entering the coverage gap, a significant portion of this out-of-pocket spending increase was offset by the 70 percent manufacturer discount in the gap. For those exclusively using brand-name drugs, the $1,250 threshold increase translated to approximately $375 in additional direct out-of-pocket costs, with the remaining amount covered by the coverage gap discount.

Proposed Policy Shifts and Potential Impacts

Policy discussions continue to shape the future of Medicare Part D and the coverage gap. One significant proposal from the Trump Administration aimed to exclude manufacturer discounts from the calculation of enrollees’ annual out-of-pocket costs. A similar provision was included in the GOP House Budget proposal for FY2019. The Congressional Budget Office estimated that implementing this proposal could reduce federal spending by $58.5 billion over a decade. However, this change would likely lead to a substantial increase in out-of-pocket expenses for beneficiaries and a decrease in the number of Part D enrollees qualifying for catastrophic coverage, potentially reverting to trends observed between 2007 and 2012. If such a change had been implemented before 2020, beneficiaries would have borne the full brunt of the $1,250 increase in the out-of-pocket spending threshold.

Moreover, there have been ongoing efforts in Congress to modify the coverage gap changes enacted by the BBA, while also seeking to mitigate the scheduled steep increase in the out-of-pocket spending threshold. These efforts to revise the BBA changes are partly driven by concerns from the pharmaceutical industry regarding the expanded manufacturer discount requirement for brand-name drugs starting in 2019. Additionally, there are concerns that reducing plans’ share of brand-name drug costs within the coverage gap could weaken their financial incentive to manage enrollees’ costs during this phase of the benefit.

While legislation to modify the BBA coverage gap provisions has not yet been introduced, policymakers are considering potential changes to the beneficiary coinsurance rate in the gap, set at 25 percent for brand-name drugs from 2019 onwards. Increasing plans’ cost share in the coverage gap and reducing the manufacturer discount below 70 percent for 2019 and beyond could result in higher Medicare spending compared to the current legislative framework. Similarly, adjusting the scheduled increase in the out-of-pocket spending threshold to protect Part D enrollees from a sharp rise in out-of-pocket costs would also lead to increased Medicare expenditure.

In conclusion, the Affordable Care Act brought about significant changes to the Medicare Part D coverage gap, primarily through the introduction of manufacturer discounts. These discounts have played a crucial role in reducing out-of-pocket costs for beneficiaries and increasing access to catastrophic coverage. However, ongoing policy debates and proposed changes suggest that the future of the coverage gap and the financial protections it offers remain subject to change, highlighting the importance of continued monitoring and analysis of these critical aspects of Medicare Part D.